FE507 – 1017

FE507 – 1017Concept of RiskRisksTypes of RisksKnown risks and their managementRisksManagement of risksPrices seem to fluctuate randomlyVolatilityContinues-time rate of returnDescrete-time rate of returnComparing two kind of returns with exampleMore volatile markets have yielded higher returnsAre rates of return normally distributed?Price = Value ?The idea of probabilityInterpretation of the probabilityIdeas from financeThe unpredictability of tomorrow’s prices

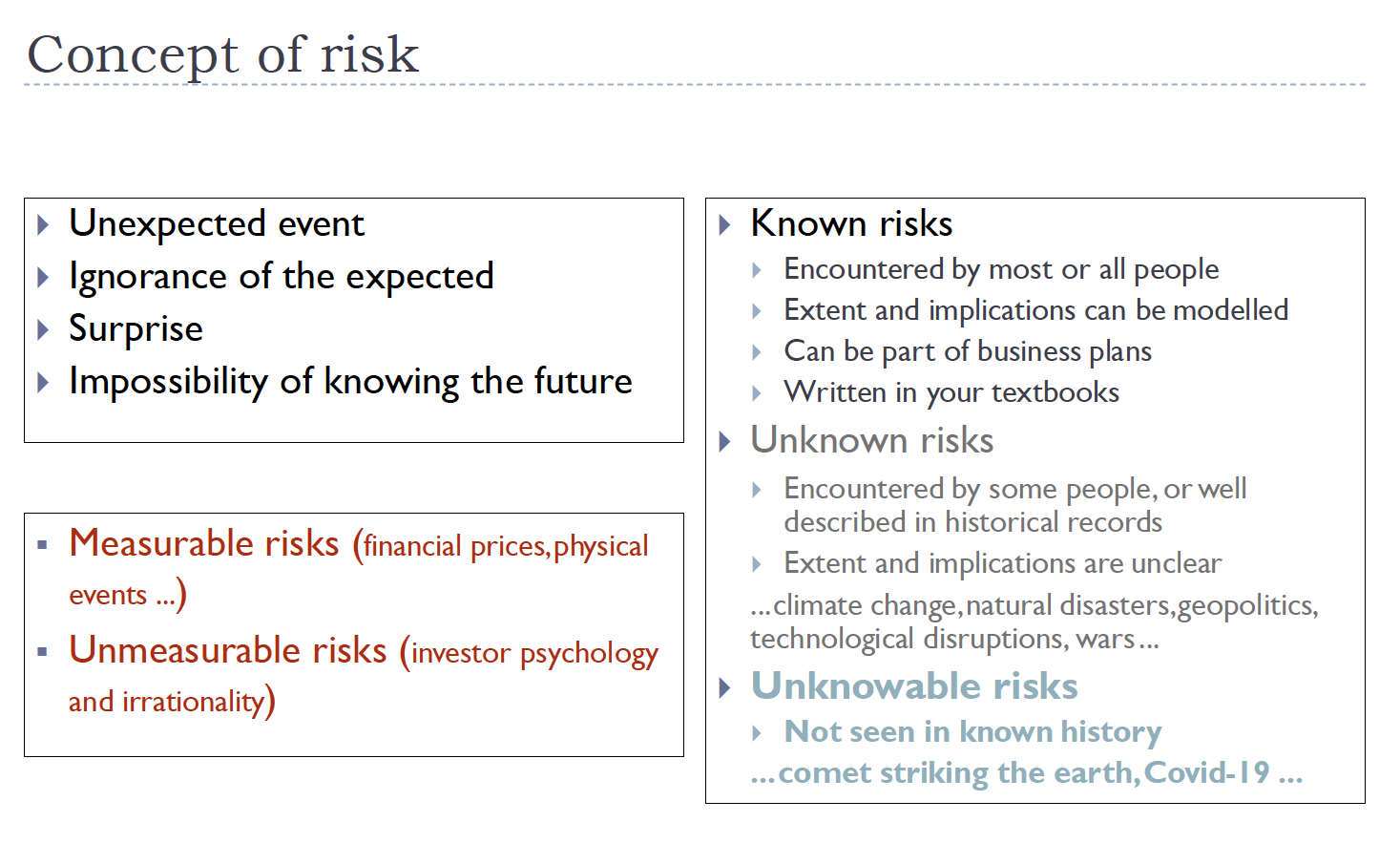

Concept of Risk

Expected events are not risks

Risks

- Unexpected event

- Ignorance of the expected

- Surprise

- Impossibility of knowing the future

Types of Risks

- Financial prices

- Physical events

Unmeasureable risks

- Investor psychology and irrationality

Known risks

- Encountered by most or all people

- Extent and implications can be modelled

- Can be part of business plan

- Written in your textbooks

Unknown risks

Encountered by some people, or well described in historical records

Extent and implications are unclear

- climate change

- natural disasters

- Geopolitics

- technological disruptions

- wars

- …

Unknowable risks

- Not seen in known history

- comet striking the earth

- Covid 19

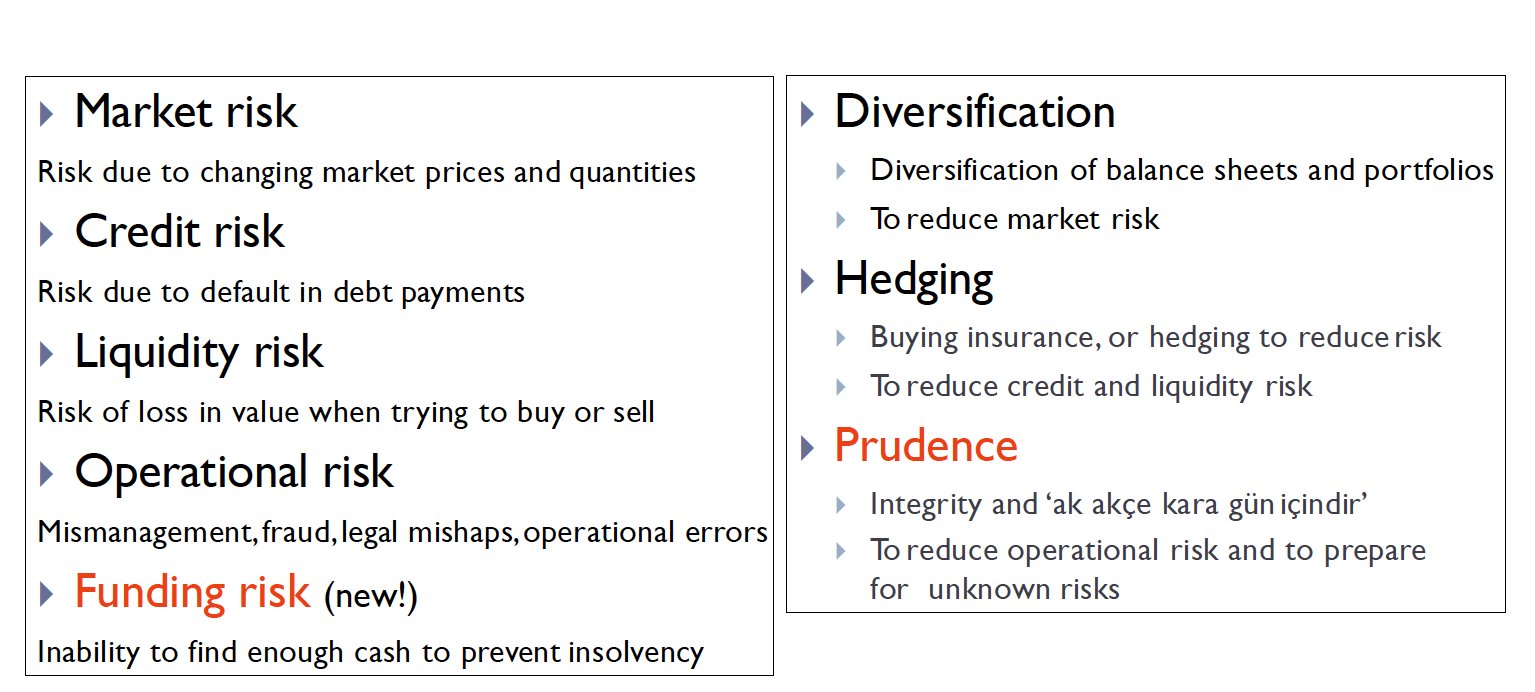

Known risks and their management

Risks

Market Risk — Diversification

- Risk due to changing market prices and quantities.

Credit risk — Hedging

- Due to default in debt payments

Liquidity risk — Hedging

- Risk of loss in value when trying to buy or sell

Operational risk — Prudence

- Mismanagement

- fraud

- legal mishaps

- operational errors

Funding risk (new)

- inability to find enough cash to prevent insolvency

Management of risks

Diversification

- to reduce market risk

- Diversification of balance sheets and portfolios

Hedging

- to reduce credit and liquidity risk

- Buying insurance

- Hedging

Prudence

- To reduce operational risk and to prepare for unknown risks

- Integrity

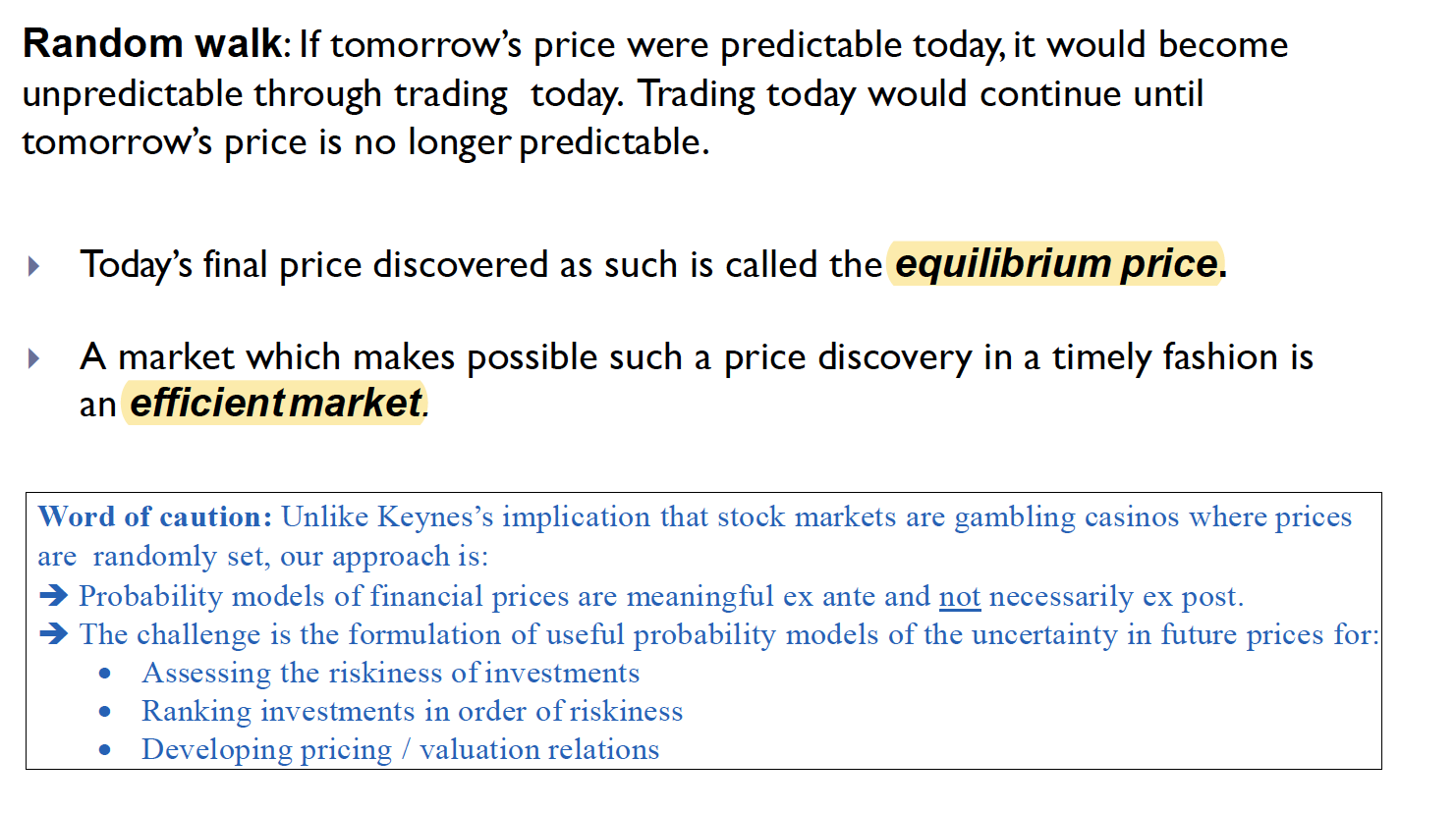

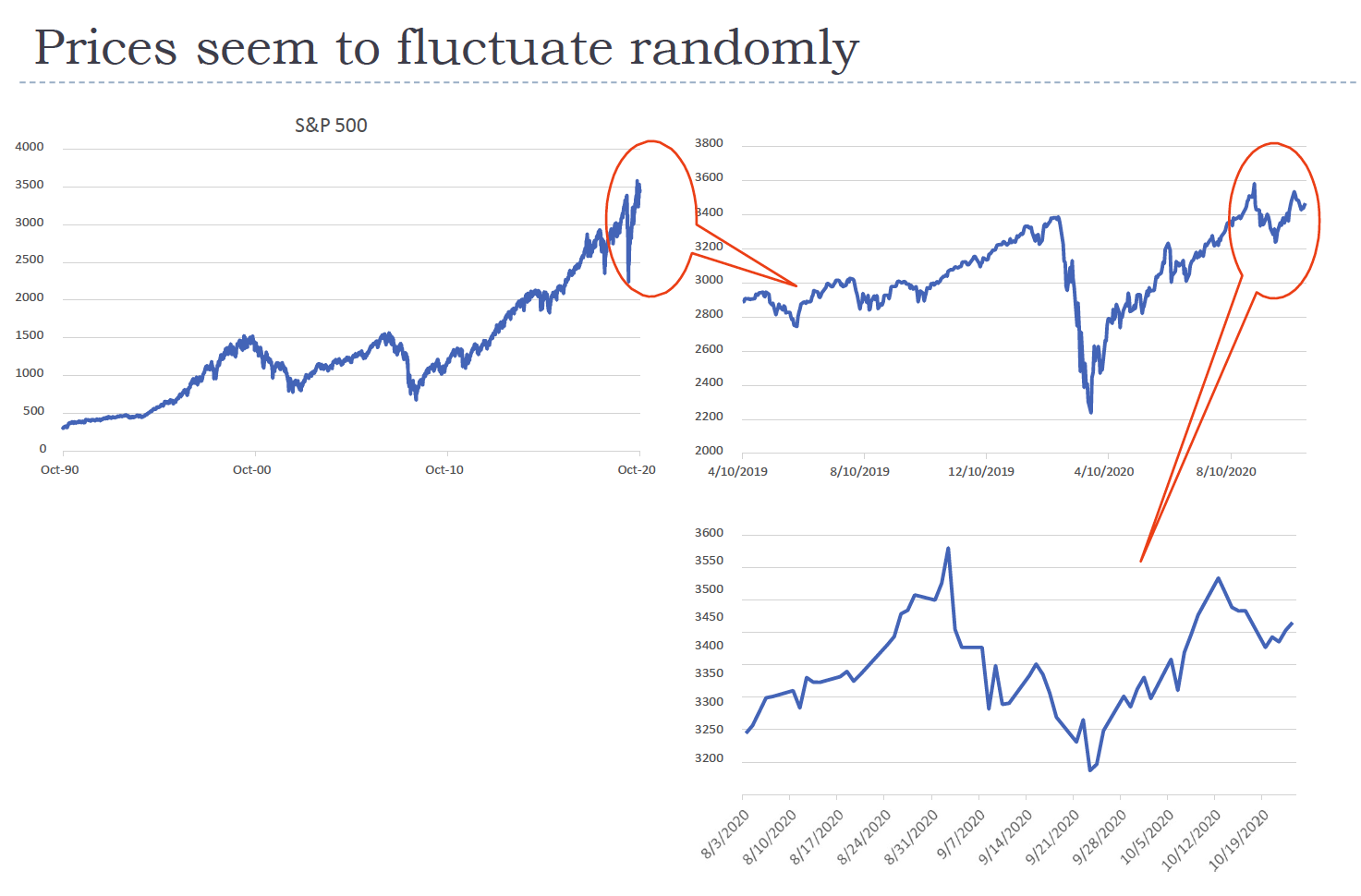

Prices seem to fluctuate randomly

Can we know where the market will be next year?

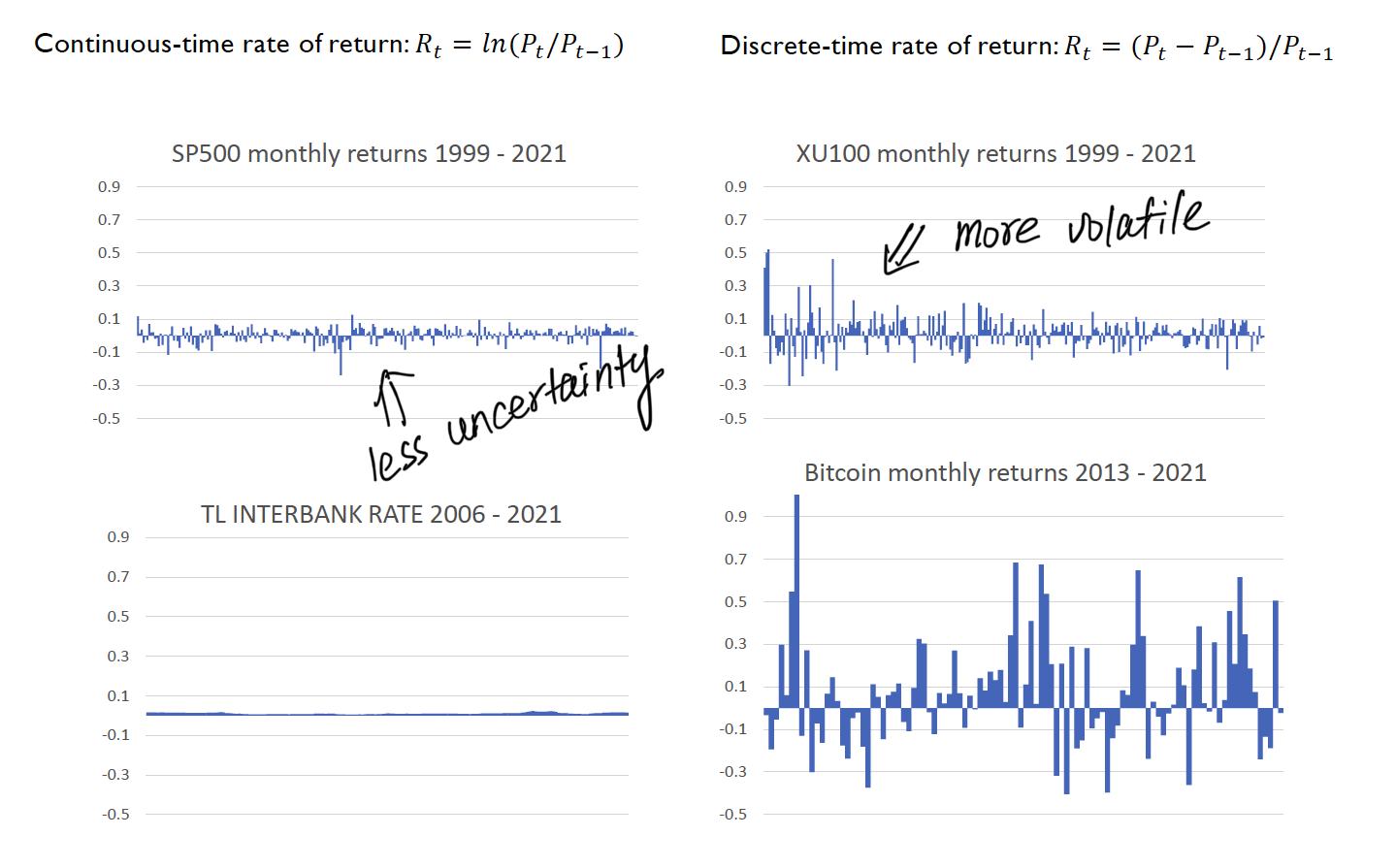

Volatility

Continues-time rate of return

Better for long term

Descrete-time rate of return

Comparing two kind of returns with example

| Time (t) | Value (v) |

|---|---|

| 0 | 100 |

| 1 | 50 |

| 2 | 100 |

Descrite-return calculation

Continues-return calculation

lie with statistics

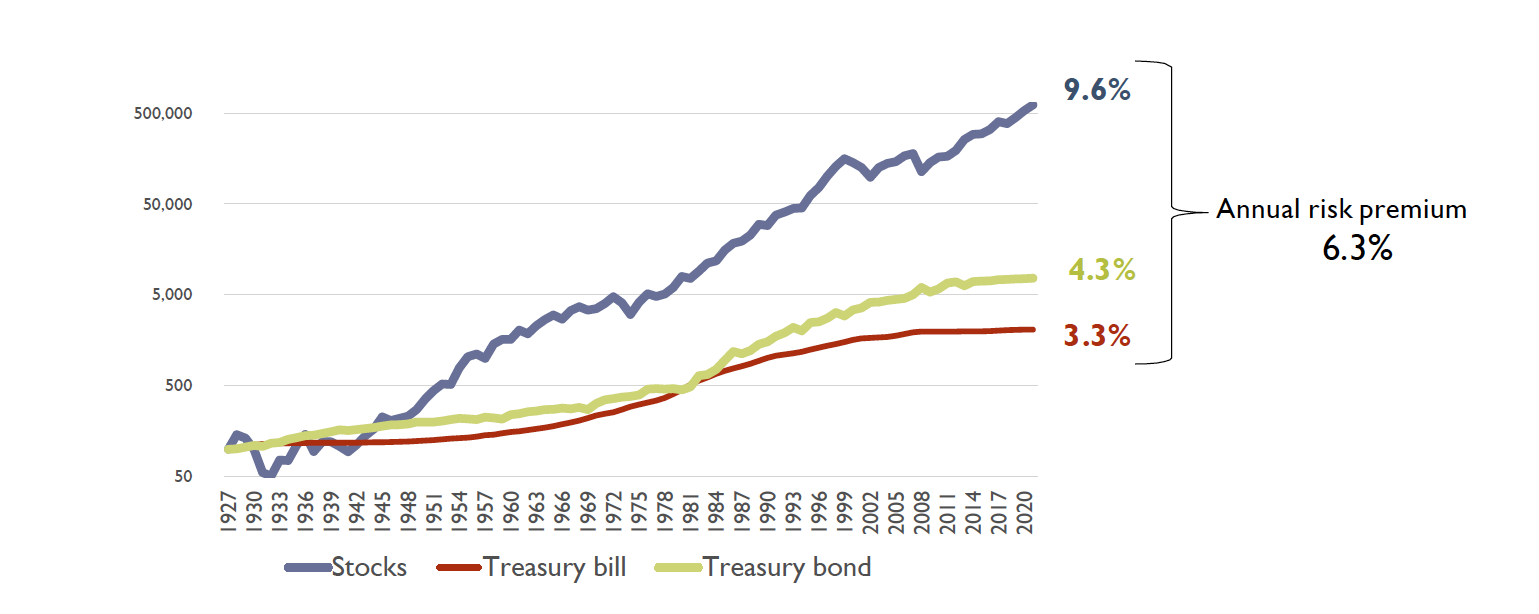

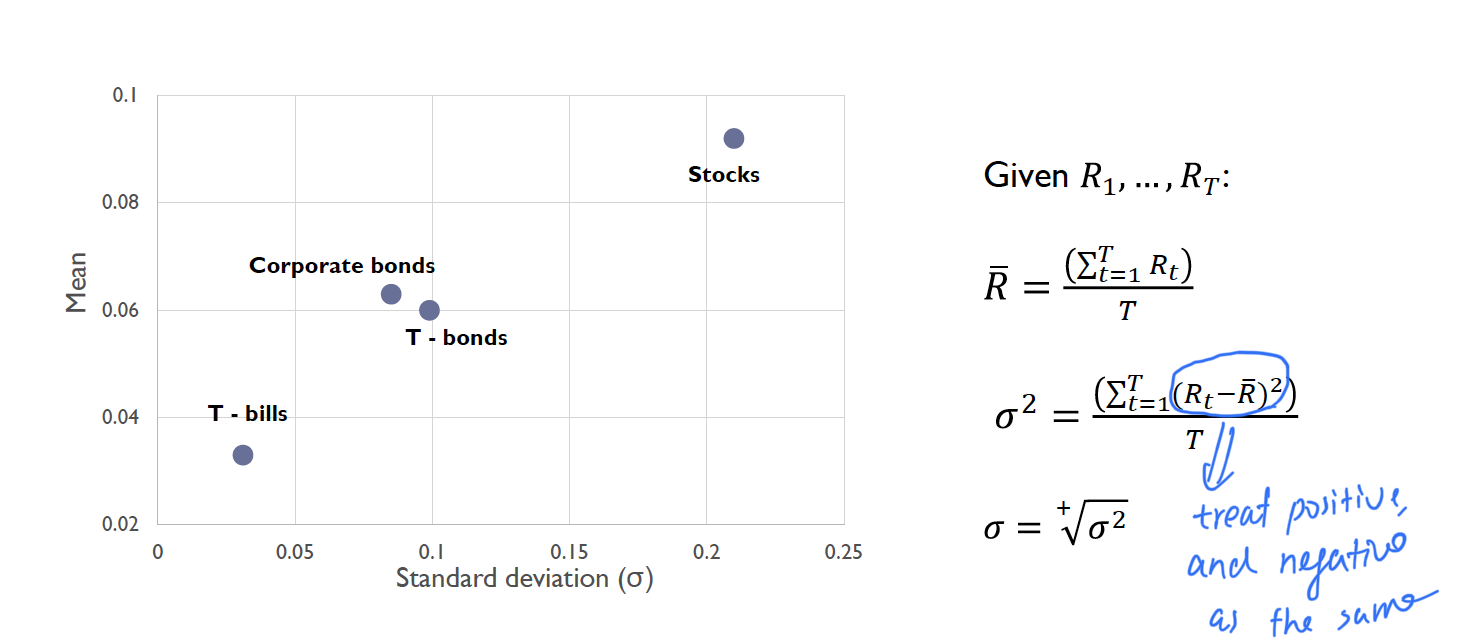

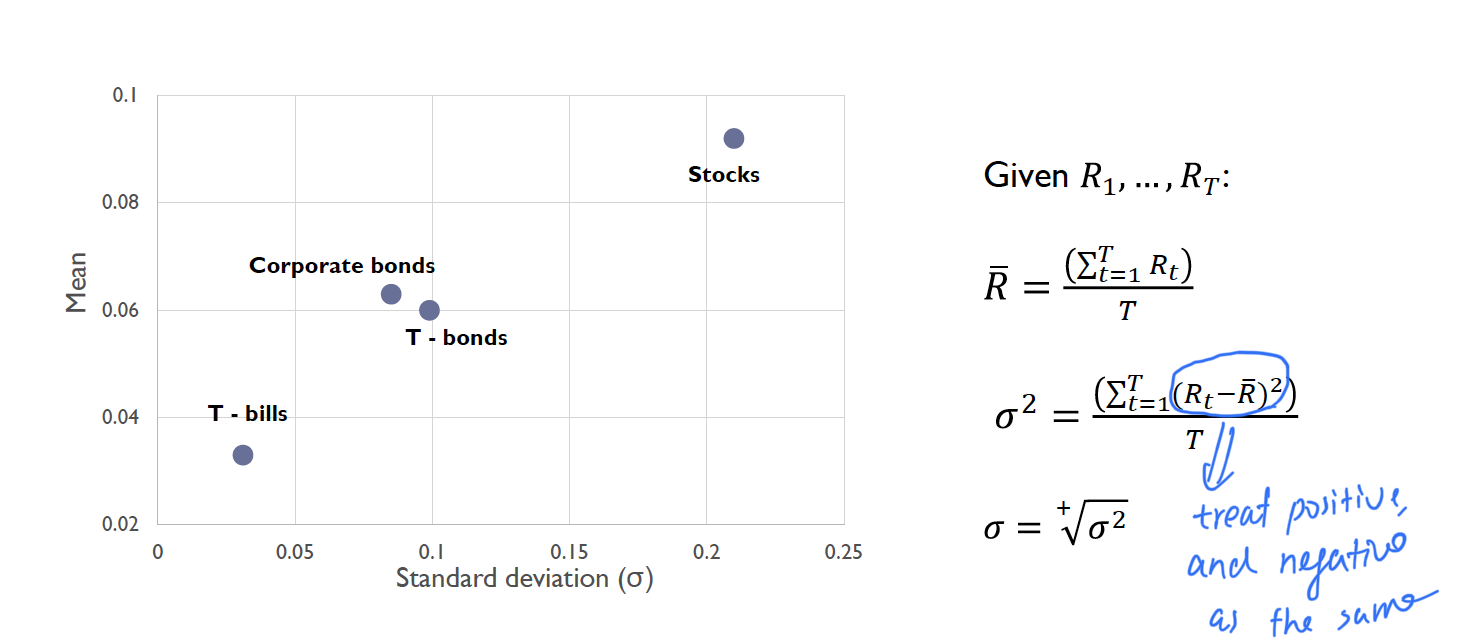

More volatile markets have yielded higher returns

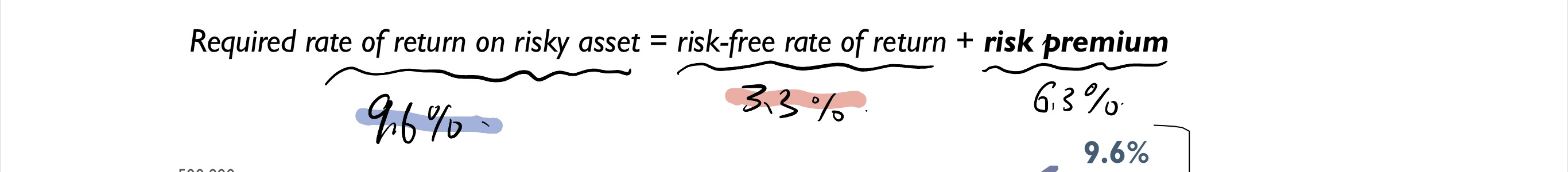

Required rate of return on risky asset = risk-free rate of return + risk premium

R (9.6%) = 3.3 % + 6.3 %

More risky asset has higher rate of return

Are rates of return normally distributed?

in the real-life scenario, the rates of return is a fat-tailed density distribution.

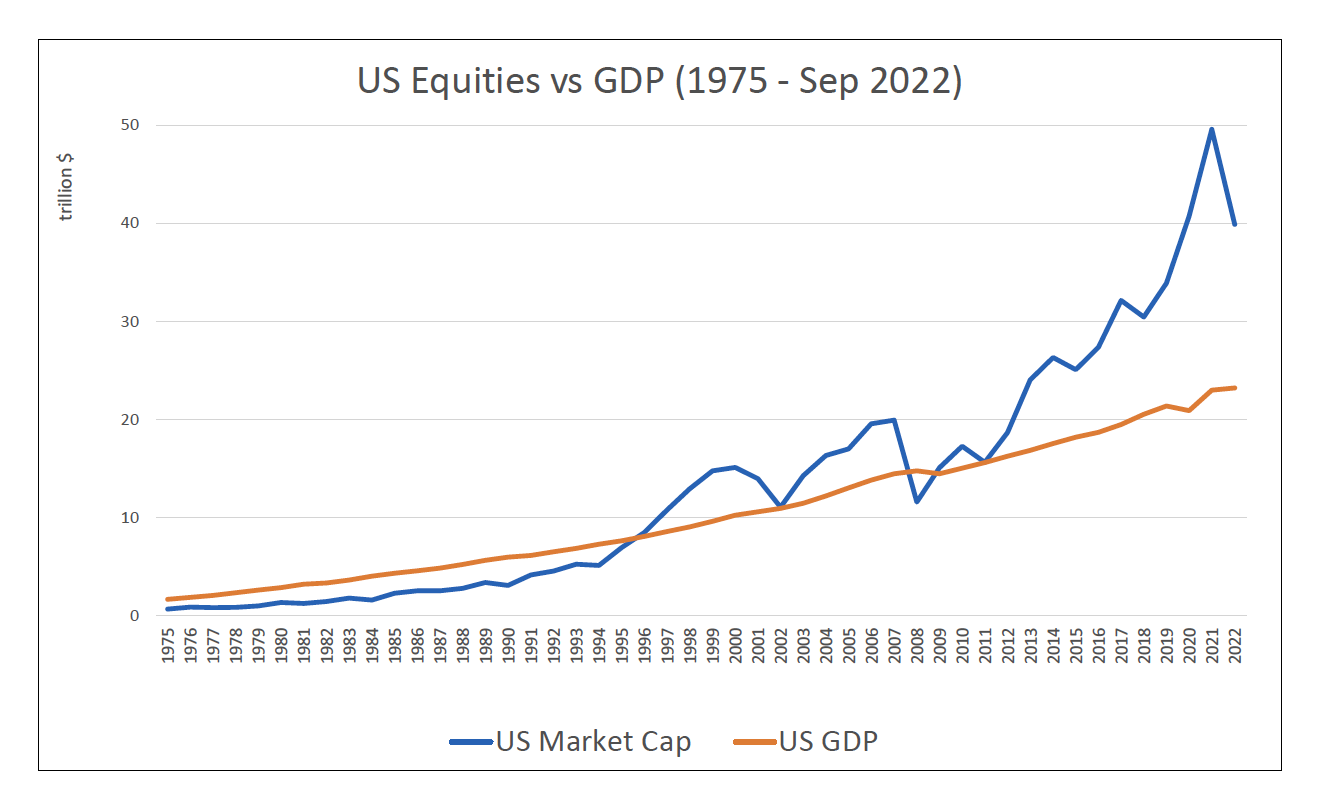

Price = Value ?

Prices of the US equities in the market is much higher than the US GDP

The idea of probability

Interpretation of the probability

Objective interpretation:

Counting of outcomes based on experiments or empirical data.

Subjective interpretation:

Subjective estimate of the likelihood of future event.

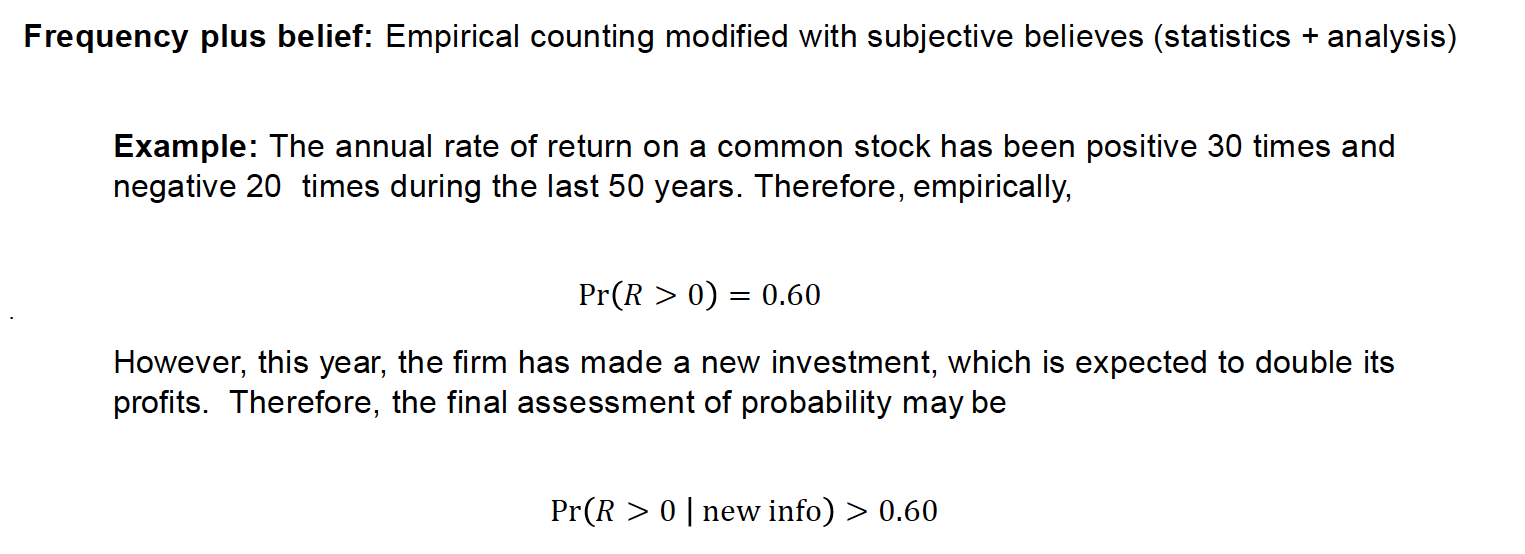

Frequency + belief:

Empirical counting modified with subjective believes ( statistics + analysis )

Ideas from finance

The unpredictability of tomorrow’s prices